Is your business actually making money, or is it just moving cash around?

It is a terrifying question for many business owners. You might see a healthy balance in your checking account, but that doesn’t necessarily mean you are profitable. Confusing cash flow with profit is one of the most common reasons businesses fail. Without a clear view of your financial performance, you are flying blind, making hiring decisions or purchasing inventory based on a “gut feeling” rather than hard data.

Fortunately, there is a tool designed to solve this exact problem: the Profit and Loss (P&L) Statement.

Also known as an Income Statement, this document is the scorecard for your business. It strips away the noise and tells you exactly how much real profit you generated over a specific period. This guide will walk you through exactly how to calculate your P&L, step-by-step, so you can stop guessing and start growing.

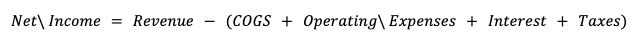

The Basic P&L Formula

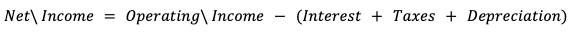

Before we dive into the line items, let’s look at the core logic. To capture the featured snippet for “P&L Formula,” here is the fundamental equation you need to know:

In simpler terms, you start with the money you made (The Top Line) and subtract every cost incurred to generate that money until you reach what is left over (The Bottom Line).

Step-by-Step Guide to Calculating P&L

Calculating your P&L follows a logical “waterfall” structure. We start at the top and subtract costs in a specific order to reveal different layers of profitability.

Step 1: Aggregate Your Revenue (The “Top Line”)

Revenue (or “Sales”) is the total amount of money brought in from selling goods or services.

- Include: All sales invoices issued during the period (if using accrual accounting) or cash received (if using cash accounting).

- Exclude: Sales tax collected (this is a liability, not income) and money from loans.

- Net Revenue: Be sure to subtract any returns, discounts, or allowances to get your Net Revenue.

Step 2: Determine Cost of Goods Sold (COGS)

These are the direct costs tied to the production of your goods or services. If you didn’t sell anything, these costs would essentially be zero. This is often where service-based businesses get confused.

Real-World Example: Consider a specialist firm like Alix Helps Interiors.

- When they purchase custom fabric or furniture specifically for a client’s renovation project, that is a Cost of Good Sold. It is a cost directly tied to that specific revenue.

- However, when they pay for their website hosting or office rent, that is not COGS it is an Operating Expense (see Step 4).

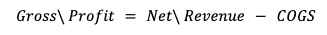

Step 3: Calculate Gross Profit

Now, subtract Step 2 from Step 1.

Why this matters: This number tells you if your core business model works. If your Gross Profit is low (or negative), no amount of cost-cutting in other areas will save the business. You either need to raise prices or lower production costs.

Step 4: Subtract Operating Expenses (OPEX)

These are the costs required to keep the lights on, regardless of how many sales you make. They are often called “Overhead” or “Fixed Costs.”

Common OPEX items include:

- Rent & Utilities

- Marketing & Advertising

- Salaries (Administrative/Management)

- Maintenance & Repairs: Regular upkeep is essential. Be sure to budget for specialized facility costs, such as high-rise window cleaning, which can be surprisingly expensive for commercial spaces.

- Software Subscriptions & Insurance

- Office Supplies

Pro Tip: Keep these categorised. Don’t just lump them into “Expenses.” Knowing exactly how much you spend on Marketing vs. Admin helps you spot bloat.

Step 5: Calculate Operating Income (EBITDA)

Once you subtract OPEX from Gross Profit, you get your Operating Income. In finance circles, this is often referred to as EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortisation). This number reflects the profitability of your daily operations before external financial factors (like debt or the IRS) get involved.

Step 6: Account for Interest & Taxes

Finally, you must deduct the “non-operating” expenses:

- Interest: Payments made on business loans or lines of credit.

- Taxes: Income taxes paid to the state and federal government.

- Depreciation: The calculated loss of value of physical assets (like machinery or computers) over time.

Step 7: Determine Net Income (The “Bottom Line”)

This is the final number.

If this number is positive, you are profitable. If it is negative, you have a Net Loss. This is the money you can legally take out of the business as a distribution or reinvest for growth.

COGS vs. Operating Expenses: The Critical Difference

Misclassifying expenses is the most common error in P&L calculation. Getting this wrong skews your Gross Profit margin, making it impossible to benchmark your business against competitors.

| Feature | Cost of Goods Sold (COGS) | Operating Expenses (OPEX) |

| Relation to Sales | Directly tied to sales volume. If sales stop, these costs stop. | Independent of sales. These exist even if you sell nothing. |

| Examples | Raw materials, manufacturing labour, shipping to customers. | Rent, CEO salary, insurance, marketing. |

| Impact | Affects Gross Profit Margin. | Affects Net Profit Margin. |

| Variability | Usually Variable. | Usually Fixed. |

Common Mistakes to Avoid

Even with a formula, it is easy to make errors that distort your financial reality. Watch out for these pitfalls:

- Confusing Cash with Revenue: If a client pays you a $10,000 deposit for work you haven’t done yet, that is technically a liability (Unearned Revenue), not revenue, under accrual accounting rules.

- Forgetting “Invisible” Costs: Depreciation is a non-cash expense. You don’t write a check for it, but your equipment is losing value. Ignoring this overstates your profit.

- Including Principal Payments: When you pay back a loan, the interest is an expense. The principal repayment is not it is a balance sheet transaction (reducing a liability). Deducting the full loan payment will artificially lower your profit.

Conclusion

Calculating your P&L is not just an exercise for tax season; it is the compass for your business. It tells you if your pricing is correct, if your overhead is too high, and if your business is sustainable.

A beautiful P&L sheet with a negative bottom line is a warning sign you cannot ignore. Conversely, a messy spreadsheet that shows consistent Net Income is a sign of a healthy engine.

If you looked at your Net Income today, would you feel confident reinvesting in your business, or would you hesitate?